Why Masonic Lodges Need Specialized Insurance Coverage

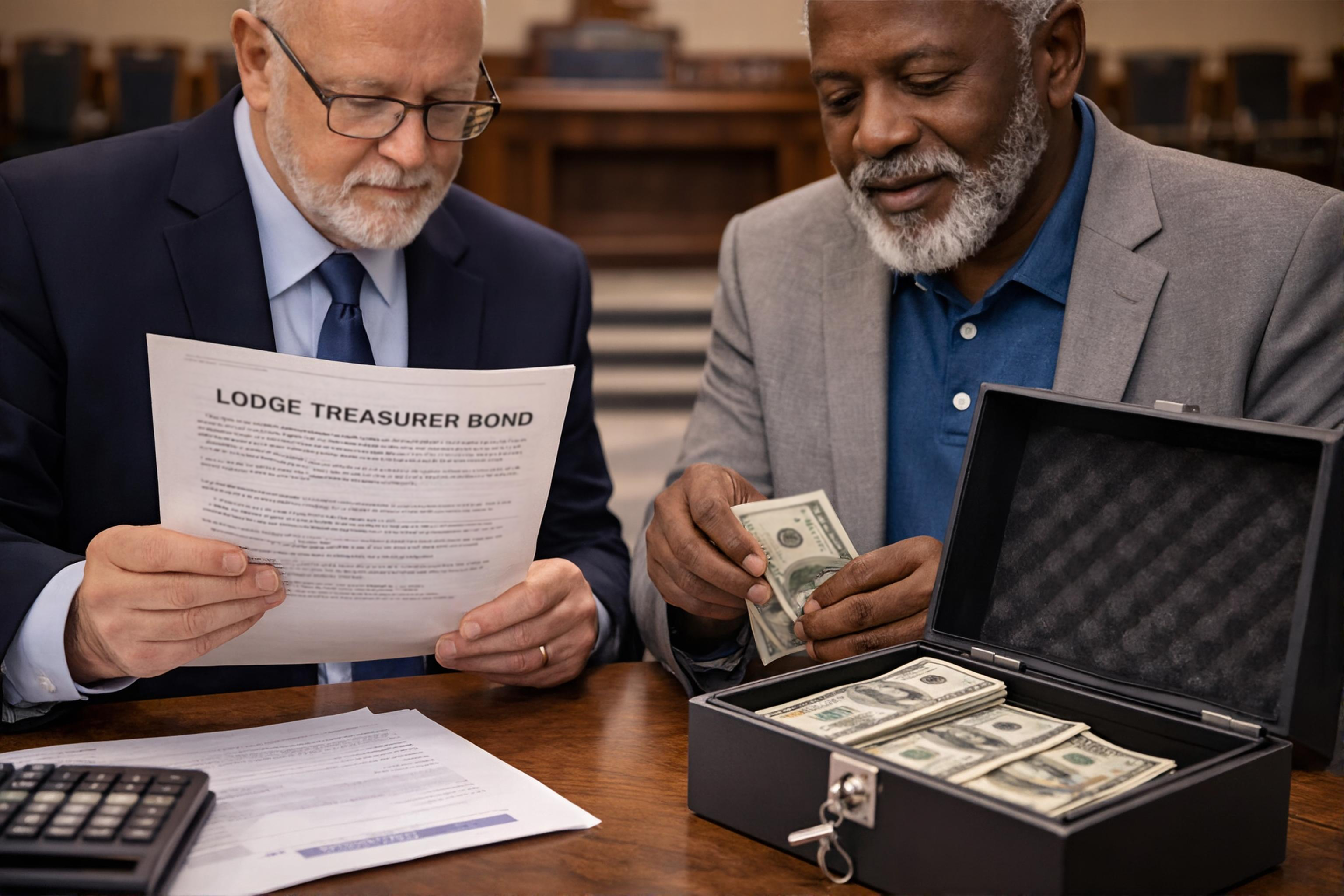

Many Masonic lodges assume standard commercial insurance is enough, but lodge operations present unique risks that generic policies often fail to address. Meetings, ceremonies, public events, and financial handling all create exposures that require specialized...

Many Masonic lodges assume standard commercial insurance is enough, but lodge operations present unique risks that generic policies often fail to address. Meetings, ceremonies, public events, and financial handling all create exposures that require specialized coverage designed specifically for fraternal organizations.

Lodge insurance helps protect against liability claims, property damage, and financial losses that can arise unexpectedly.

Without proper coverage, a single incident can place the lodge and its officers at serious financial risk. Specialized policies account for how lodges actually function, rather than forcing them into a business insurance model that does not fit.

Insure My Lodge works with lodge leadership to identify real risks and close coverage gaps. This ensures lodges remain protected while continuing their mission of fellowship, charity, and community service.